How to start LLC Business in Nigeria

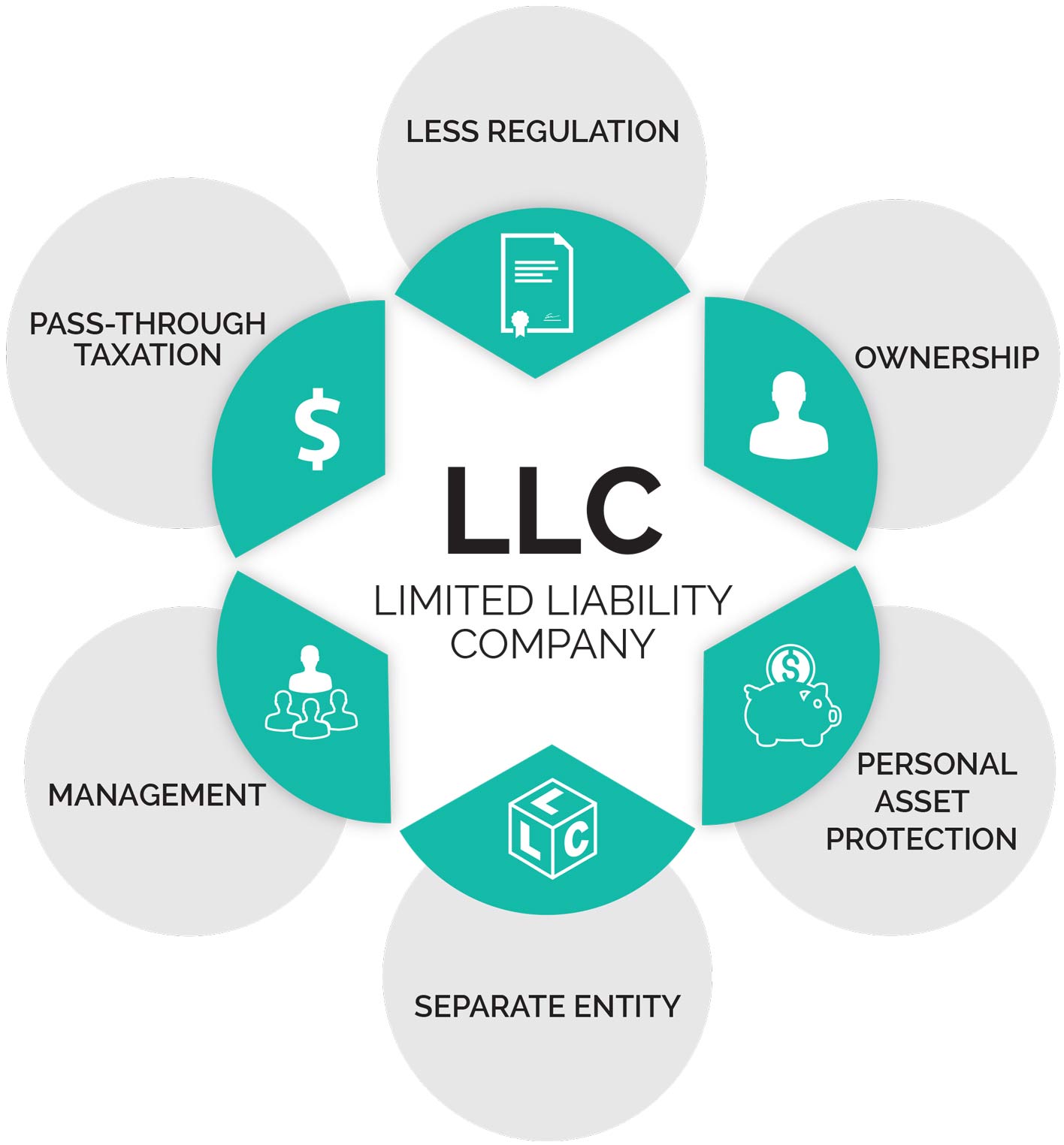

LLC stands for Limited Liability Company. Starting an LLC is the simplest way of structuring your business to provide personal liability protection.

Starting your business as an LLC helps to protect you against lawsuits, significantly cuts down on paperwork compared to other business types, prevents your business from being taxed twice, and helps to present your business as more credible.

Get expert advice on becoming a successful business owner with BusinessHAB Business category! Our step-by-step articles can help you navigate the ins and outs of the business world, from forming a public limited company (PLC) to measuring company growth of an existing company. Learn how to avoid unionization of a company, identify industry trends, implement efficiency strategies, and more! You can request publication of your article for publication by sending it to us via our Email below.

An LLC is just one of several business structures. Other common examples include:

- S-Corporation

- C-Corporation

- General Partnership

- Sole Proprietorship

For most small businesses, LLCs offer the right mix of personal asset protection and simplicity. Unlike sole proprietorships and general partnerships, LLCs offer limited liability. Unlike corporations, LLCs are relatively easy to form and maintain, and are not subject to double taxation.

Personal Asset Protection

Provided there is no fraud or criminal behavior, the owners of an LLC are not personally responsible for the llc’s debts or lawsuits.

Pass Through Taxation

An LLC’s profits go directly to its owners, who then report their share of the profits on their individual tax returns. Hence, an LLC’s profits are only taxed once. This is known as pass-through taxation. In a C-Corporation, profits are subject to “double taxation”: profits are taxed before being distributed to owners and taxed again when owners report their share of profits on their individual tax returns.

Simplicity

LLC are relatively easy to form and maintain with little paperwork. Unlike C-Corporations and S-Corporations, LLCs are not required to assign formal officer roles, hold annual meetings, or record company minutes and resolutions.

Flexibility

There are few restrictions on how you can structure the ownership and management of an LLC. Your LLC can be single member or multimember; it can be managed by its members or by managers who are appointed by the members. In addition, an LLC can elect to be taxed as a corporation if that is more beneficial.

Note: If you plan to start a multi-member LLC, we highly recommend drafting an operating agreement to protect the members from future legal disputes.

Increased Credibility

Forming your business as an LLC brings added credibility. An LLC is recognized as a more formal business structure than a sole proprietorship or partnership. Including LLC in your business name lets customers and partners know that you are a serious business.

Access Business Loans

Once you have formed an LLC, your business can begin building a credit history. This will help your business access loans and lines of credit.

Disadvantages of an LLC

The main disadvantage of an LLC is that you can’t list your business on the stock market. So, it can be difficult to obtain funding from Venture Capital firms unless you convert your LLC into a Corporation.

People starting a business for the first time often ask where they should form their LLC. There is a lot of hype about forming in the following states: Delaware, Nevada and Wyoming. However, in most cases you should form a domestic LLC in the state where your business will be located.

To understand why, consider this comparison:

Scenario A: John starts a business in Michigan and registers his LLC in Michigan. He pays a filing fee and an ongoing maintenance fee each year to keep his LLC in good standing.

Scenario B: Mike opens a business in Michigan but chooses to register his LLC in Delaware. Because his business is located in Michigan, his Delaware LLC must also register a foreign LLC in Michigan. Mike is now paying filing fees and maintenance fees in two separate states. He has double the paperwork and pays twice as much as John.

So Why the Hype about Forming a Business in Delaware?

Some large investors and bankers prefer working with Delaware businesses due to Delaware’s business friendly laws. However, this rarely offers enough of an advantage to the small business owner to justify the added cost and paperwork of registering in multiple states

What about Wyoming and Nevada?

Nevada and Wyoming have more relaxed business laws than most other states, hence they are becoming popular. However, unless your business is based in one of these states, your Nevada or Wyoming LLC will still need to register as a foreign LLC in the state where you conduct business. So you will be paying more and filing paperwork in two separate states.

Does it ever make sense to Form an LLC Outside your Home State?

If your business will have a physical presence in multiple states, then you will have to register as a foreign LLC in multiple states. In this case, there may be advantages to forming your business as a domestic LLC in Delaware, Nevada or Wyoming, depending on your specific needs.

How to Form an LLC?

Forming an LLC is easy. Our State-by-State LLC Formation Guides break the process down into five easy steps. You can either follow our DIY guide, or hire a service provider like LegalZoom or IncFile to form your LLC for you.

Five Basic Steps to Start an LLC:

- Step 1. Select a State

- Step 2. Name your LLC

- Step 3. Choose a Registered Agent

- Step 4. File the Articles of Organization

- Step 5. Create an Operating Agreement

Types of LLCs

All LLCs offer the same features that make them a unique hybrid of other business entities: limited liability and pass-through taxation. However, some LLC types work best for a particular business scenario. Here are the most common types of LLCs:

Domestic LLC

An LLC is referred to as a “domestic LLC” when it is conducting business in the state in which it was formed. Normally when we refer to an LLC we are actually referring to a Domestic LLC.

Foreign LLC

When an existing LLC decides to open offices or have any other kind of physical presence in a new state, it needs to register in that state as a foreign LLC. For example, if an LLC “organized” in Texas opens a business establishment in Michigan, then your Texas LLC will need to also form in Michigan as a Foreign LLC.

Professional LLC

A Professional LLC is a Limited Liability Company that is organized to perform a professional service, for example a medical or legal practice. To form a Professional LLC, it is necessary for certain members of the LLC to possess the necessary state licenses to demonstrate their professional qualifications. In a Professional LLC, the limitation on personal liability does not extend to professional malpractice claims. Therefore, before forming a Professional LLC it is advised to seek legal counsel.

LLC Frequently Asked Questions

How Much Does it Cost to Form an LLC?

The costs of forming an LLC will vary from State to State. In general, you can expect to pay a minimum of between $50 and $500 to form your LLC, and around $100 annually to maintain your LLC. These costs will increase if you hire a lawyer or use a professional service provider.

What is a Registered Agent?

A registered agent is a person or business nominated by your company to officially receive and send papers on your behalf. Such papers include service of process of legal action, and state filings.

You cannot form an LLC without having a registered agent. The registered agent must be a resident of the state in which you wish to form your LLC. If you are forming a domestic LLC, you can choose to act as your own registered agent.

What is an Operating Agreement?

An LLC Operating Agreement is a legal document that outlines the ownership and operating procedures of your Limited Liability Company. This agreement allows you to set out the financial and working relations among business owners (“members”) and between members and managers.

What are the Articles of Organization?

The Articles of Organization is the legal document you submit to your state when forming your LLC. This document will contain important information related to your LLC, such as:

- Your LLC’s name

- Your LLC’s purpose

- The name and address of your registered agent

How are LLCs Taxed?

LLCs do not pay federal income tax like C or S-Corporations. LLCs have pass-through taxation. This means that the LLC’s profits pass through to its members, who then have to pay taxes on their share of the earnings on their individual tax returns. Multi-member LLCs must, however, file an annual earnings report to the IRS.

Although LLCs are pass-through entities, there are several types of state-level tax that may still apply to your LLC:

Franchise Tax

Many states levy a “franchise tax” on LLCs, which is either a flat-rate annual fee, or a percentage of your LLCs annual earnings.

Unemployment Tax and Income Witholding Tax

If your LLC has employees, you will need to register for Unemployment Insurance Tax and Income Withholding Tax.

Sales Tax

If your LLC sells taxable goods or services, you will need to register for a sellers permit and collect sales tax on behalf of your state.

What is an LLC License?

There is no such thing an LLC license. To form your business as an LLC, simply follow the steps above in the How to Form an LLC section.

Regardless of their legal structure (LLC, Sole-proprietorship, C-Corp, etc.), many businesses require a state business license in order to conduct business.

How Long does it take to Form an LLC?

The standard processing time is approximately two to three weeks. However, many states offer same-day or expedited LLC formation for an extra fee.

Do I need a Lawyer to Form an LLC?

No. Our LLC formation guides cover all the steps to form an LLC in all 50 states. To save time, you may choose to hire a service provider . If you are thinking about forming a Professional LLC, such as a legal or medical practice, it is recommended to consult a lawyer.

Does an LLC have a Board of Directors?

Unlike corporations, LLCs are not required to have a board of directors. An LLC is typically managed by its members, unless the Articles of Organization appoint a non-member manager to manage the LLC.

Does an LLC have Shareholders?

LLCs do not have shareholders and are not able to sell shares on the stock market. Instead, an LLC is owned by its members, who split the business earnings among one another. The way your LLC’s earnings will be divided should be explicitly stated in your Operating Agreement.

Can I Form an LLC in Another State?

If you already have a domestic LLC and wish to expand your business to another state, you will need to form a foreign LLC in that state. Generally it is not recommended to form an LLC in a state where you do not plan to conduct business.

If you need a complete business plan, please let us know. Or, you want us to help you set up this business, kindly contact us.

I know you would also want to check out these other business ideas

i want to do my LLC, can you recommend somebody